What is Section 179?

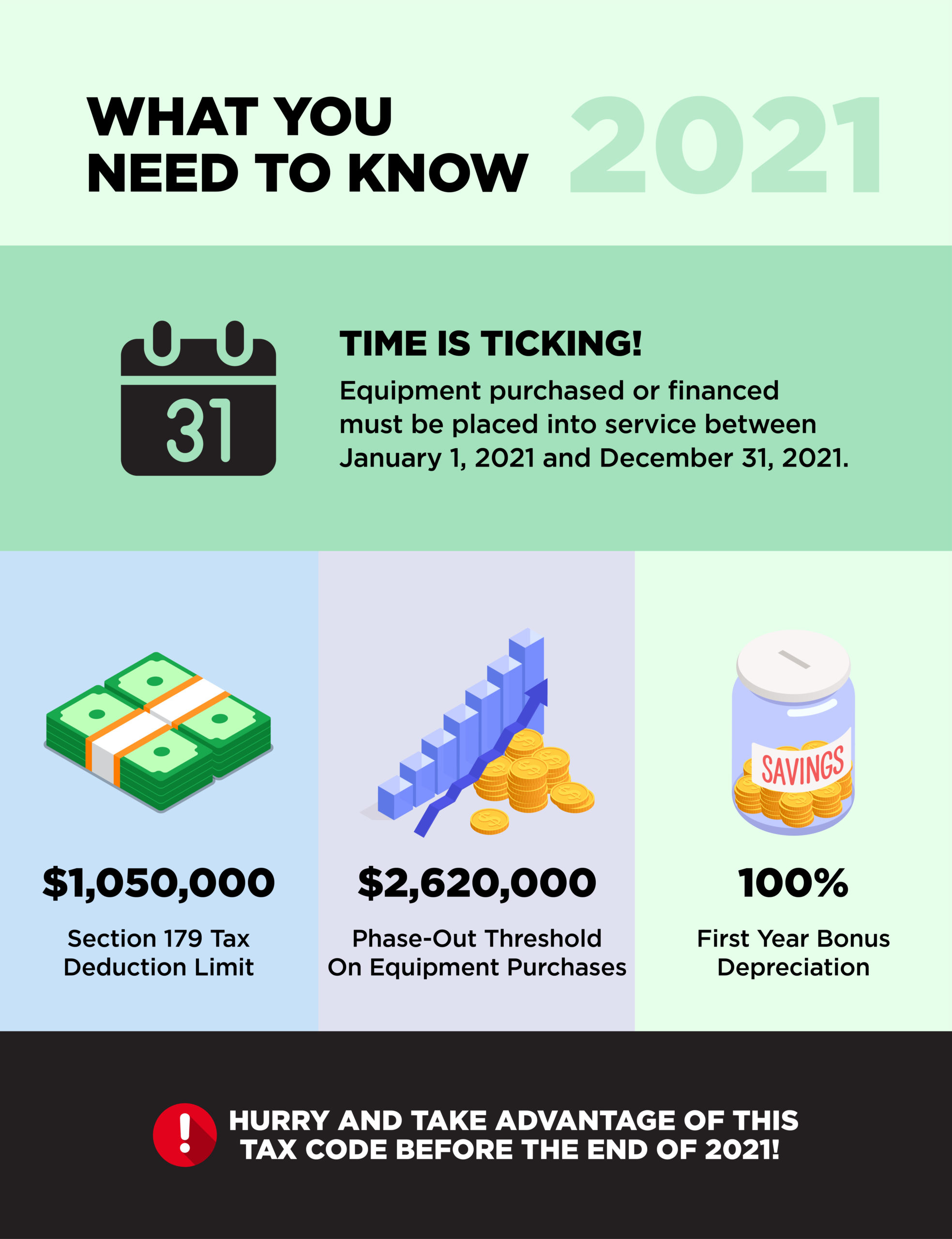

Section 179 is a tax incentive to encourage businesses to purchase the equipment now and invest in themselves, allowing them to write off the whole purchase as opposed to waiting a couple of years through depreciation. The catch is that the eligible piece of equipment must be purchased and put into service by midnight 12/31/2021. There are currently no plans to waive the “put into service” requirement during the current supply chain issues.

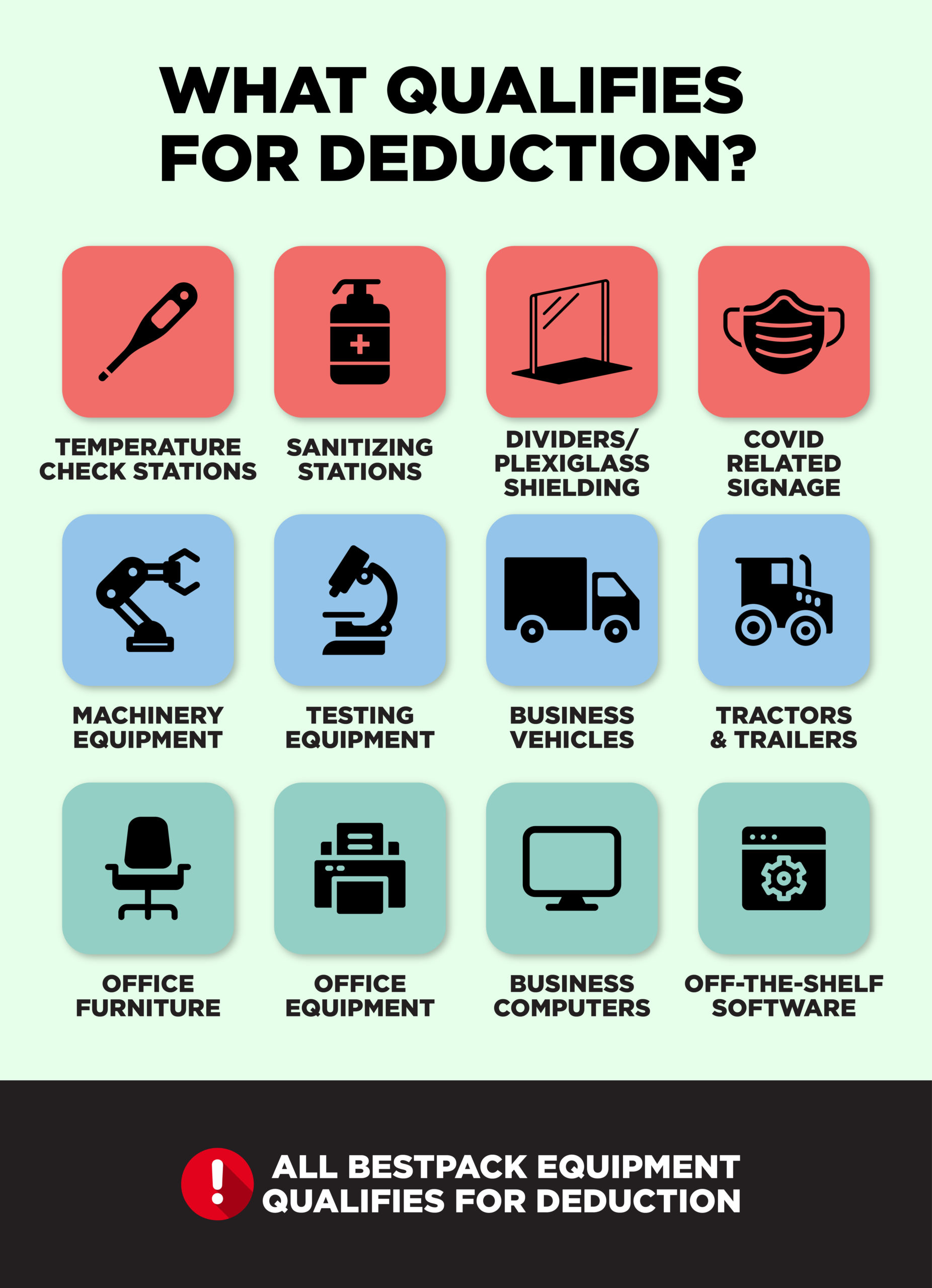

Section 179 & COVID-19

In order to conform with COVID-19 restrictions, other tangible equipment has been added to the tax deduction. This includes sanitizing stations, temperature check stations, dividers/plexiglass shielding, new printed signage, and similar business equipment purchased to modify the workspace for employees and/or the public. The same rules still apply, all eligible equipment purchased must be purchased in 2021 and put into service by December 31, 2021.

Section 179 Deduction Limit – 2021

The deduction limit has increased in 2021 to $1,050,000 (up from $1,040,000 in 2020). This deduction is good for both new, used, COVID-19 safety equipment, and off-the-shelf software. To benefit from the deduction, the equipment must be purchased and be placed into service between January 1, 2021, and the end of the day on December 31, 2021. Remember there is still a spending cap of up to $2,620,000. Any amounts after that start to phase out and the deduction goes away once $3,670,000 in purchases is reached. For more information visit www.section179.org

Section 179 & BestPack

BestPack has built its business on helping companies automate their sealing process and boost efficiency. We focus on high-quality products for your business, innovation through customized solutions for our customers, and we continue to provide your future growth with our equipment. With over 35+ years in the industry and selling to over 48 different countries around the world, we guarantee that if we don’t have a solution for you we can build it!

If you’re making the changes in your business to automate your packaging process we’re here to help with that! Free up your employees to take on more challenging tasks and let BestPack automate your process to boost productivity and increase your bottom line.

If you’re looking to start your automation journey with BestPack, start off by meeting our most popular operator-fed adjustable carton sealer. The MSD is a top-of-the-line machine, designed to seal a variety of light-to-heavy duty uniform carton closure applications. Using side belt technology, the MSD will seal very narrow to wide cartons at a maximum of 40 cartons/min.

What if you have to need a more advanced automation piece? We have just the machine! Check out our CSS – it’s a fully automatic random servo-driven carton sealer built for fast height and width adjustments to create a smooth sealing operation. It has three independent stations to center, flap fold, and seals your random cartons. The CSS is designed for speed and allows for precise positioning at each station. Sealing up to 30 cartons/min.

The great thing about BestPack equipment is that it qualifies for the Section 179 tax deduction! Take advantage of it before the year ends. Find your carton solution by clicking here!