Your manufacturing floor is humming with activity, boxes of freshly produced goods are moving down the conveyor belt, and you’re itching to take your business to the next level. You know that automation is the game-changer, a quantum leap towards efficiency, cost-cutting, and the edge you need in a fiercely competitive market.

But there’s a giant, almost intimidating wall you’re hesitant to climb—investment costs. Sleek, high-tech packaging automation systems and machinery don’t come cheap. The dollars rack up, and let’s face it, the financial burden is not something you can just sweep under the rug.

So, what if we told you there’s a financial life-hack tailor-made for businesses like yours? What if the secret to affording the sort of operational boost that only automation can provide lies in the most unexpected of places: the tax code? Intriguing, isn’t it?

Say hello to Section 179, your ticket to sustainable growth and a leaner, meaner, and more efficient operation. Stick around, because by the end of this read, you’ll know exactly how to make the tax code work for you, grow your business, and how BestPack, a leader in the packaging automation world, can be a part of this transformation.

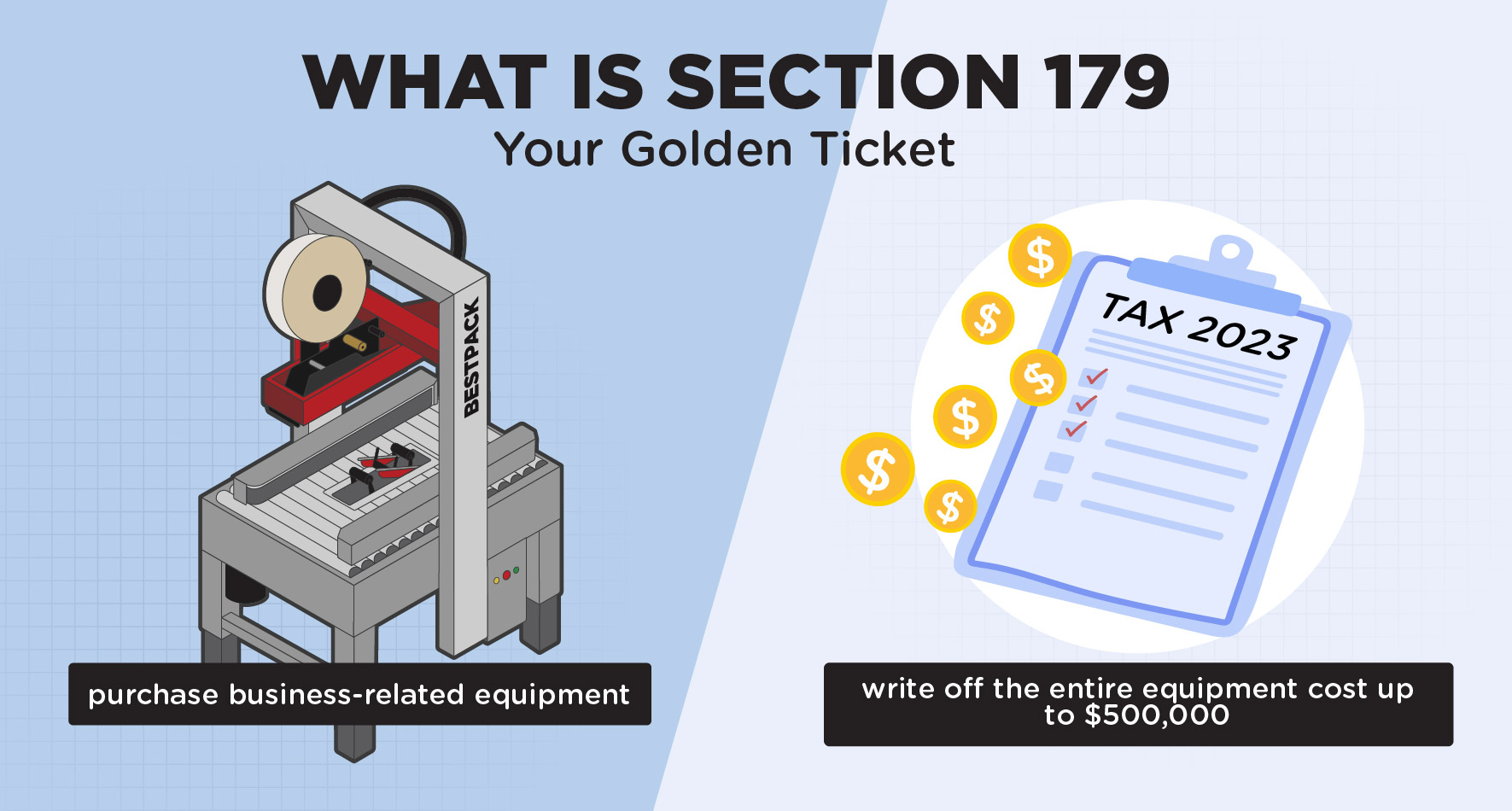

The Section 179 Deduction is like the “Black Friday” of tax codes for small and medium-sized businesses. It’s a golden ticket that allows you to purchase up to $500,000 in business-related equipment and write off the entire cost that very year.

In layman’s terms, you get to buy what you need to make your business more competitive, and then you get a tax break for doing so.

How cool is that?

Don’t be misled by its humdrum name; Section 179 is a game-changer. Introduced as a temporary measure under the Bush administration, this tax incentive was meant to stimulate the economy by encouraging businesses to invest in themselves.

Over time, the law has morphed into something even more straightforward and permanent—no more complicated depreciation schedules, just pure, unadulterated tax relief.

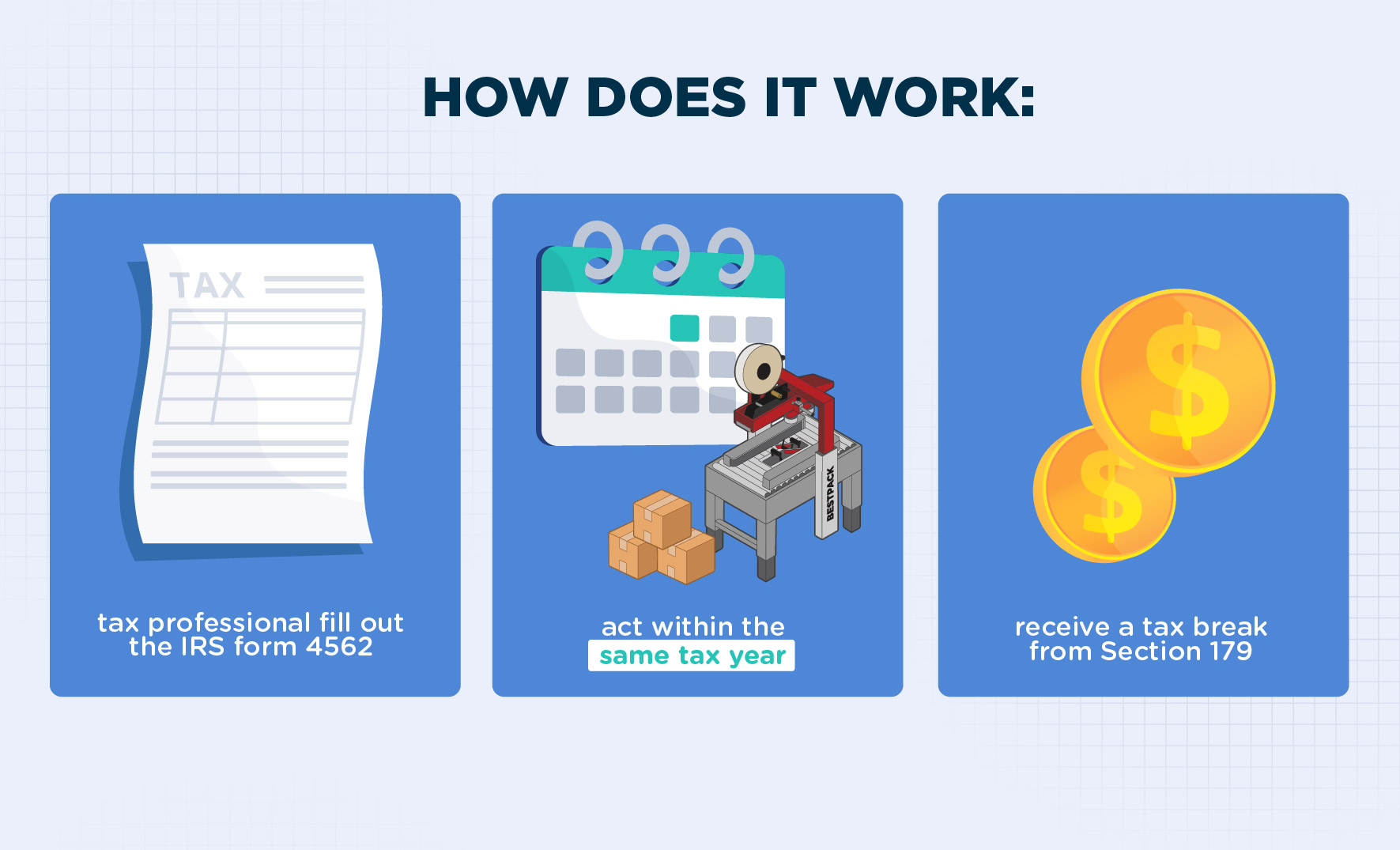

First, let’s be clear on the eligibility. If you own a business, you’re likely eligible. While the deduction does focus on small and medium-sized businesses with its $500,000 limit, it’s open to almost all. To make this work for you, ensure that you or your tax professional fill out the IRS form 4562.

And remember, the key here is to act within the same tax year you make the purchase. Yes, that means you can buy that BestPack automated carton sealer you’ve been eyeing, and, voila, write it off on your taxes for that same year.

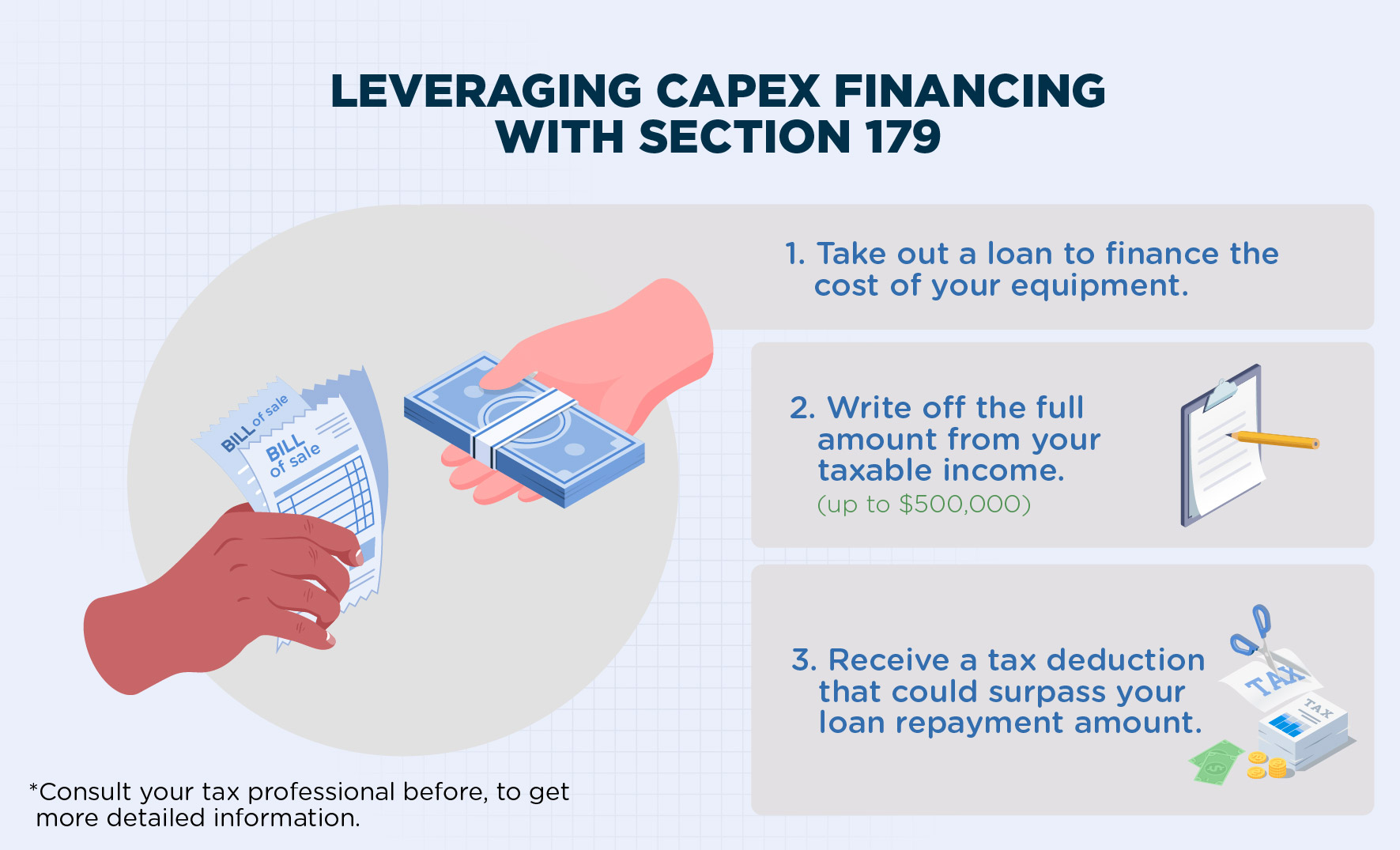

Now, if you’re thinking, “Great, but where do I get the cash upfront to make the purchase?” we’ve got you covered. Capital Expenditure (Capex) Financing is the yin to Section 179’s yang. In a nutshell, you can take out a loan to cover the cost of the equipment and use Section 179 to get a tax deduction that could very well surpass your loan repayment amount.

Let’s break that down. Say you finance a state-of-the-art BestPack packaging system for $100,000. Through Section 179, you write off the full $100,000 from your taxable income. If your tax rate is 30%, you save $30,000 in taxes. If your loan repayments for the year are less than this—congratulations, you’re practically getting paid to modernize your business!

So, you’re now familiar with the nuts and bolts of Section 179 and Capex Financing. The gears are turning in your head, and you’re ready to take action. The question remains: How do you select the right equipment to elevate your business?

Look no further than BestPack, your next strategic partner in revolutionizing your packaging operations.

Let’s break down how BestPack can fine-tune your process:

Imagine a machine so advanced it practically hums a tune of efficiency and affordability. Meet BestPack’s CSF, a servo-driven, fully automatic random carton solution. The CSF isn’t just a machine; it’s a precisely engineered asset.

Thanks to its servo motor on the flap-folding section, it delivers unmatched accuracy. This is the high-precision tool that will cut your packaging time in half without breaking the bank.

When it comes to reliability and operational smarts, the ELVS, BestPack’s Uniform Carton Erector, takes the cake. Fitted with low tape and no-tape sensors, a dedicated vacuum pump for air suction cups, and more, it goes beyond the basics to deliver unparalleled efficiency. The ELVS isn’t just reliable; it’s the industry standard for carton erectors.

Are you just starting your automation journey? Consider the MSD, BestPack’s manual sidedrive solution. It seals uniform cartons but offers much more than that. With its versatile design, the MSD can be customized to fit your specific needs. It’s an adaptable solution that will grow as you do.

BestPack brings over 40 years of engineered quality and manufacturing reliability to more than 48 countries. From packing produce to cosmetics, from sealing medical products to eggs—our range of over 100 carton sealer models and carton erectors are not just machines; they’re strategic assets.

And here’s the cherry on top: All these BestPack marvels—CSF, ELVS, and MSD—are eligible for the Section 179 tax deduction. Investing in BestPack is essentially like choosing a road that leads to operational efficiency, while Uncle Sam foots part of the bill.

Before you dive in head-first, you’ll probably want to crunch some numbers to see how BestPack solutions, Section 179, and Capex Financing could actually affect your bottom line. No worries, we got you covered. Head on over to this Tax Deduction Calculator to start plugging in figures.

Just to paint a picture: If you decide to invest $250,000 in a BestPack packaging automation system, you could potentially write off the entire $250,000 thanks to Section 179. At a 30% tax rate, you save $75,000 in taxes. If you financed this equipment and your total repayments for the year were, say, $60,000, you’ve already profited $15,000.

We can’t think of a quicker way to make money while also making your business more efficient.

While we can provide you with the basics, this is where we put on our “not-a-tax-advisor” hat. Always consult a tax professional before making any substantial investments. They’ll help you navigate the fine details of Section 179 and confirm how it’ll mesh with your overall financial situation.

Just because the government is offering a tax break doesn’t mean they’re going to spoon-feed it to you. Ensure that you or your tax professional fill out IRS Form 4562 to take advantage of Section 179. Filling out this form makes the whole process official and ensures that you’re not leaving any money on the table.

Investing in your business should never be a decision made lightly, but with opportunities like Section 179 and Capex Financing, the risk diminishes while the rewards multiply. You’re not just buying equipment; you’re investing in a catalyst that will propel your business to new heights.

And don’t fret about the specifics; BestPack offers an extensive support system of field technicians throughout the United States. From installation to maintenance, they’re with you every step of the way, making sure your investment runs smoothly and efficiently for years to come.

When you take advantage of Section 179 by integrating BestPack’s cutting-edge automation solutions into your operations, you’re taking a decisive step towards a future where your business is leaner, faster, and more competitive. And remember, time waits for no one. The sooner you act, the sooner you’ll be reaping the rewards of a smarter, more efficient business.

Reach out to BestPack and explore the wide array of automated and semi-automated packaging system applications that you can finance through Capex and write off thanks to Section 179.