In the world of business, timing is everything. And for those looking to enhance their packaging operations. Section 179 of the tax code, a powerful incentive for business investment, has been extended and enhanced for 2024. We’ll explain how this deduction can revolutionize your packaging line and why BestPack is your ideal partner in this endeavor.

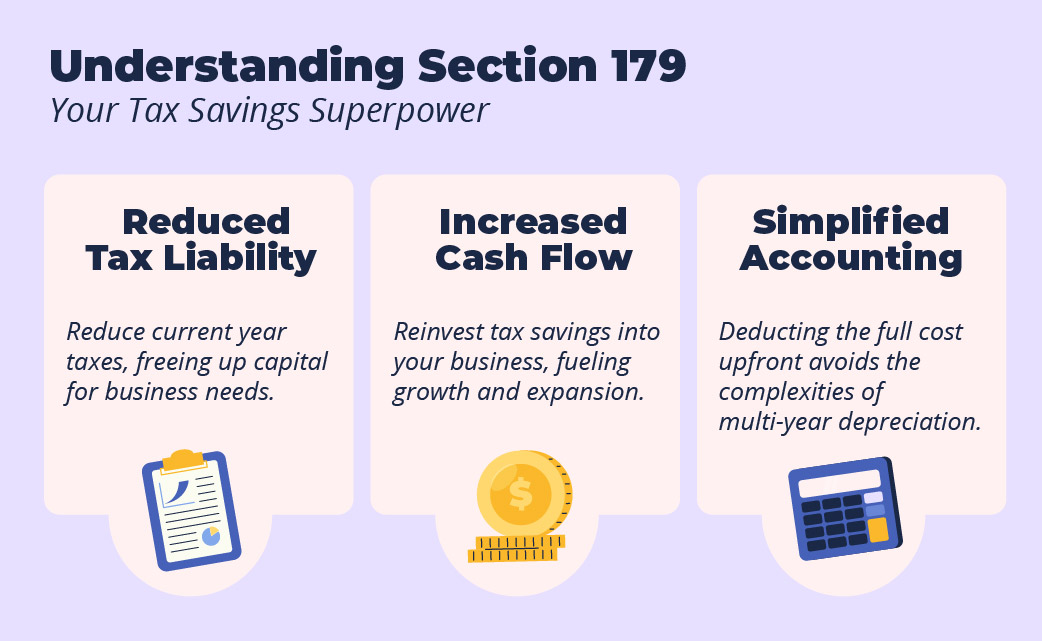

Section 179 is a unique tax deduction that can significantly impact your business’s bottom line. Instead of gradually depreciating the cost of qualifying equipment over several years, Section 179 empowers you to deduct the entire purchase price in the year the equipment is placed in service. This immediate deduction translates to:

This deduction is not just for large corporations; it’s designed to benefit small and medium-sized businesses as well. With BestPack and BPX Solutions offering a wide range of qualifying packaging equipment, you can harness the power of Section 179 to upgrade your operations while maximizing your tax savings.

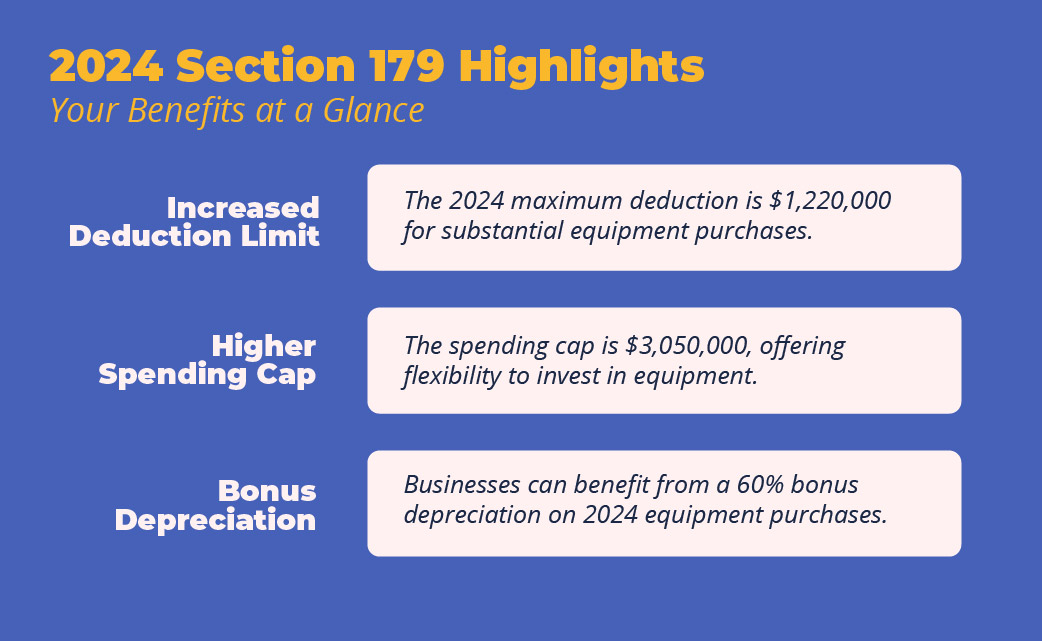

2024 is a particularly advantageous year for businesses looking to invest in new equipment due to significant enhancements to the Section 179 deduction:

These combined benefits can significantly reduce your tax burden and accelerate your return on investment. It’s a financial opportunity that savvy business owners won’t want to miss.

The good news is that most small and medium size businesses are eligible to claim the Section 179 deduction. It likely qualifies as long as the equipment is acquired and put into service for your business between January 1st and December 31st, 2024. For a comprehensive list of eligible properties, consult with your tax advisor or refer to the IRS website.

BestPack and BPX Solutions offer a comprehensive range of packaging equipment that not only qualifies for the Section 179 deduction but is also designed to propel your business forward dramatically:

BestPack, along with our BPX Solutions line, specializes in providing high-quality, customizable packaging solutions that are not only eligible for the Section 179 deduction but also designed to transform your packaging operations. Our equipment is engineered to improve efficiency, reduce waste, and enhance productivity – key factors in maintaining a competitive edge.

Tax laws are subject to revisions, and the current benefits under Section 179 and bonus depreciation are not guaranteed to last. With potential changes looming in the coming year, you must act now and secure these deductions for your business.

The Section 179 deduction, combined with BestPack’s exceptional equipment, presents a golden opportunity to not only enhance your packaging capabilities but also save significantly on your taxes. Don’t miss out on this strategic advantage.

Reach out to BestPack today and let us partner with you on your journey to packaging excellence.

Phone:

1.888.703.2851

Email:

sales@bestpack.com